Real estate is one of the most significant investment classes in Nepal. From family-owned plots to large-scale housing projects, land and property ownership symbolize security, prosperity, and long-term stability.

However, in recent decades, Nepal has witnessed a sharp rise in property prices, often outpacing average household income. This trend has raised pressing questions: Why is land becoming so expensive? What role does inflation play? And how do these shifts affect ordinary Nepali citizens?

This article offers a comprehensive examination of the impact of real estate inflation in Nepal, encompassing definitions, drivers, economic effects, real-world data, case studies, and policy recommendations. By the end, you will understand not only the causes of real estate inflation but also its consequences and possible solutions.

1. Understanding Inflation in the Context of Real Estate

Inflation refers to the general rise in prices of goods and services over time. When inflation increases, every sector, including real estate, is affected. In real estate, inflation impacts three core areas:

- Construction Costs: Prices of cement, bricks, steel, sand, labor, and imported materials rise, making houses more expensive.

- Land Value: Since land is limited and non-replicable, inflation amplifies demand pressure, pushing land prices higher.

- Financing & Borrowing Costs: Higher inflation often prompts the Nepal Rastra Bank to increase interest rates. As a result, mortgages become costlier, discouraging some buyers.

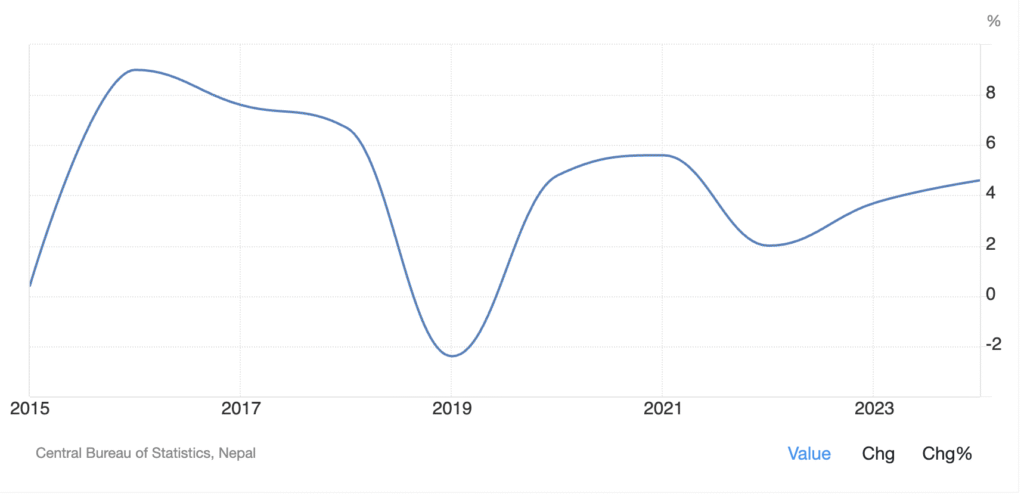

In Nepal’s case, average inflation hovers between 6-8% annually, yet real estate prices in urban areas often rise by 15-25% per year, a gap that suggests speculation, remittance flows, and land scarcity drive prices beyond inflation alone.

2. Major Drivers of Real Estate Inflation in Nepal

Urbanization and Population Growth

Nepal is urbanizing rapidly, and according to the Central Bureau of Statistics (CBS), 21% of the population lived in urban areas in 2001, while by 2021, that figure had jumped to nearly 66%. Kathmandu Valley, in particular, attracts students, workers, and entrepreneurs. Consequently, land in Kathmandu, Lalitpur, and Bhaktapur has become extremely scarce.

For example:

- A plot in Baneshwor that cost NPR 20 lakhs per aana in 2010 now sells for NPR 80–90 lakhs per aana in 2025.

- In Bhaktapur’s Suryabinayak area, land that was NPR 10 lakhs per aana in 2012 is now above NPR 60 lakhs per aana.

This skyrocketing land appreciation is far above average wage growth.

Rising Construction Costs & Imported Inputs

Nepal relies heavily on imported materials. Cement, iron rods, paints, glass, tiles, and even fixtures often come from India and China. When global prices rise or the Nepali Rupee weakens against the U.S. Dollar, costs surge.

For instance, the Russia-Ukraine war caused a global steel price hike. Nepali builders had to pay nearly 40% more for steel rods in 2022, instantly inflating housing costs. Developers rarely absorb these expenses; instead, they transfer them to buyers.

Remittances and Investment in Land

Remittances contribute to about 25% of Nepal’s GDP. Many families use this income not for consumption but for property purchases.

- A migrant worker in Qatar or Malaysia may send money home, and families often view buying land as a safe investment.

- This pushes demand further, even when actual housing supply remains low.

Remittance-driven demand has created a culture where land is viewed as a “golden egg”, fueling persistent inflation

Infrastructure Development

Infrastructure has a direct multiplier effect on real estate. When a new road, bridge, or transport link is introduced, nearby land values rise dramatically.

- Kathmandu-Terai Fast Track: Areas near Nijgadh have seen rising land transactions due to speculation that the new airport and highway will transform the region.

- Ring Road expansion: Prices in Kalanki, Satungal, and Balkhu surged as connectivity improved.

Therefore, inflation is not only about global prices but also local development expectations.

Speculation and Black Money in Real Estate

A unique aspect of Nepal’s real estate inflation is the role of speculative investment and informal (undocumented) money. Many business persons purchase land plots not to build houses but to hold them as speculative assets. Later, they sell at a much higher price.

Additionally, since land transactions often involve large amounts of cash, the sector has become a preferred channel for unrecorded wealth. This inflates prices artificially, beyond actual demand-supply dynamics.

Banking Practices and Loan Collateralization

Nepali banks frequently accept land as collateral for business and personal loans. Consequently, people borrow money against land, purchase additional plots, and fuel a cycle of speculative investment.

While Nepal Rastra Bank has tried to tighten loan-to-value (LTV) ratios, inconsistent enforcement means speculative borrowing continues to influence property prices.

3. Real Estate Market Trends: Data Insights

Let’s examine real transaction data from Fiscal Year 2081/82 (2024/25):

| Month (FY 2081/82) | Transactions (Units) | Revenue (NPR billions) | YoY Growth (%) |

|---|---|---|---|

| Shrawan | 43,835 | 3.83 | +11.2% |

| Bhadra | 32,798 | 3.09 | +7.5% |

| Asar | 55,524 | 6.55 | +20.2% |

| Chaitra | 49,832 | 4.39 | +14.6% |

| Baisakh | 52,423 | 4.54 | +9.8% |

| Jestha | 56,010 | 4.72 | +10.1% |

- Asar recorded the highest YoY growth of 20.23%, highlighting peak seasonal activity.

- Revenue growth consistently outpaces inflation, suggesting inflation is not the only factor; speculation and remittance inflows are equally influential.

4. Case Studies: Nepal’s Regional Real Estate Stories

Kathmandu Valley: The Epicenter of Inflation

Kathmandu, Lalitpur, and Bhaktapur have seen relentless price growth. Housing developers argue high land costs make affordable housing impossible. Middle-class families are increasingly priced out, renting instead of buying.

For instance:

- An average 3BHK house in Kapan cost NPR 1.2 crores in 2016. Today, similar houses cost NPR 3–3.5 crores.

- Rentals have also surged, with apartments in Baneshwor demanding NPR 35,000–50,000 per month, far above average household income.

Biratchowk: The Rising Star of the East

Biratchowk in Morang district has become one of the fastest-growing real estate hubs in Nepal. Land prices here have even overtaken parts of Kathmandu, due to commercial expansion and highway connectivity.

In 2015, land was NPR 4–5 lakhs per kattha. By 2025, some prime areas sell for NPR 25–30 lakhs per kattha.

Pokhara: Tourism and Real Estate

Pokhara, with its booming tourism industry, has attracted investors both Nepali and foreign. Consequently, lakeside plots and surrounding hillside lands have appreciated enormously. Guesthouses and boutique hotels dominate transactions, fueling inflation beyond residential needs.

4. Consequences of Real Estate Inflation in Nepal

- Housing Affordability Crisis: Middle-class and low-income families are pushed to the periphery, unable to afford central housing.

- Rising Rent Burden: Households in Kathmandu spend 20–25% of monthly income on rent, compared to less than 10% in rural areas.

- Widening Inequality: Landowners accumulate wealth, while non-owners struggle, deepening the class divide.

- Banking Risks: Heavy reliance on land as collateral may destabilize financial institutions if a property bubble bursts.

- Urban Sprawl: As central areas become unaffordable, unplanned expansion into peri-urban areas accelerates, straining infrastructure.

5. Policy and Strategic Recommendations

To address these issues, Nepal must adopt a multi-dimensional approach:

- Affordable Housing Incentives: Government subsidies for mid-range apartments, especially for first-time buyers.

- Speculation Control: Tax on vacant plots and undeveloped land to discourage hoarding.

- Loan Regulation: Stricter monitoring of land-based collateral lending.

- Infrastructure Balancing: Encourage growth in secondary cities like Butwal, Dharan, Nepalgunj, and Birgunj to reduce Kathmandu-centric pressure.

- Transparency: Digitization of land records to curb black money transactions.

Conclusion

Nepal’s real estate inflation illustrates the complex interplay of global inflation, remittances, urbanization, speculation, and infrastructure growth. While rising property values benefit landowners and developers, they pose serious challenges for affordability, banking stability, and social equity.

Ultimately, without effective regulation and proactive policy, Nepal risks widening inequality and deepening an affordability crisis. Yet, with strategic reforms, the country can balance growth and sustainability ensuring that real estate serves the many, not just the few.

Read More: How to Maximize Returns from Your Rental Properties in Nepal

Join The Discussion